Introduction:

Satoshi Nakamoto introduced Bitcoin in 2009 which was the first digital currency. With it, came the revolutionary concept of blockchain technology. The technology was designed for secure and decentralized transactions. Later, in 2015, another cryptocurrency, Ethereum was launched which gave the idea of smart contracts (self-executing agreements encoded directly onto the blockchain). This means blockchain origin is firmly rooted in cryptocurrency but its potential today extends far beyond digital currencies. Research shows that blockchain holds the promise of transforming industries. It can enable secure, transparent, and efficient systems for a wide range of applications. One hottest topics these days is blockchain in real-world assets (RWA). But the core question we will explore here is:

How blockchain characteristics can transform real-world asset (RWA) management? And after its implementation, what will be the future of investments and global financial systems? Let’s start:

Key Takeaways:

- RWAs include tangible and intangible assets like real estate, commodities, and intellectual property, which are tokenized for improved liquidity, accessibility, and efficiency.

- Tokenization addresses traditional challenges like illiquidity, high costs, geographical barriers, and lack of transparency.

- Institutional adoption is increasing, with key players like MakerDAO, BlackRock, and Coinbase already investing in RWA tokenization.

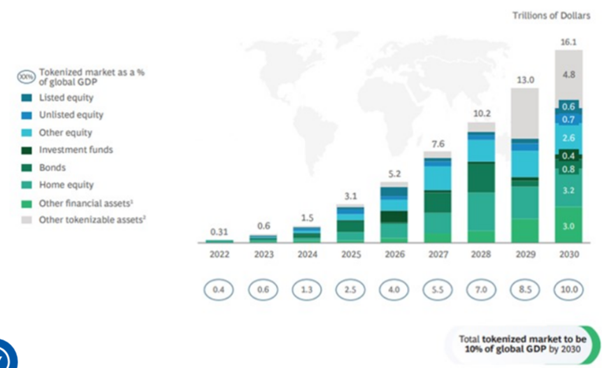

- The market for tokenized RWAs is expected to grow significantly, with estimates reaching $16 trillion by 2030.

What Are Real World Assets (RWAs)?

RWAs or Real-world assets are assets that can be touched in real life and can be physically seen. They have an intrinsic value and they can be tangible or intangible. For example: real estate, commodities, art, infrastructure and any intellectual property that can provide value to the global economy. However, the major challenge is RWA management or real-world asset management. Traditionally the processes were slow and costly and limited to geographical and regulatory barriers when managing, buying, and selling these assets. However, blockchain showed potential in this domain. One key application is tokenization of real-world assets which is a solution to streamline traditional processes. This means asset tokenization can make real-world assets easier to trade, invest, and transfer ownership without the inefficiencies tied to traditional systems.

What Are Blockchain-based RWAs And Why Do They Matter?

Let’s start with tokenization which is a blockchain application. It simplifies owning and trading assets. The concept involves converting physical or intangible assets into digital tokens. When an asset is tokenized, it is divided into smaller parts, known as tokens, each representing a share of that asset. This fractional ownership of assets is securely recorded and managed on blockchain. As a result, assets become accessible, liquid and tradeable globally. Blockchain-based assets matter because they provide a key advantage – a transparent and secure way to track ownership. Blockchain keeps a record of each transaction, verifies it and makes it immutable and reliable for liquidity, accessibility, and traceability of these assets on a global scale.

Market Size and Opportunity

Two and a half years ago BSG reported, that the blockchain-based RWA market has seen tremendous growth. The estimates suggest that it could reach $16 trillion by 2030. However, the market has failed to reach the growth rate predicted for 2024. McKinsey & Co. published its predictions that it would be less than $2 trillion by 2030, with a range of $1 to $4 trillion. BSG made annual predictions but McKinsey refrained from it. It is a strategy that shows long-term forecasts that might change as the market develops. Notable, all the projections are according to a static measure of tokenized assets. However, when we look at transaction volumes, there is an upward trend, indicating the growing adoption of tokenized assets, even if the overall market size isn’t expanding as initially predicted.

This represents a cold start but a massive opportunity for institutional investors and for individuals and businesses that want to access new types of investments. It means blockchain application, tokenization offers a pathway to a more inclusive and efficient global economy.

Benefits of Blockchain for Real-World Assets

Consultants say that if institutions leverage blockchain for RWAs, they can transform traditional asset management by getting these key advantages:

- Enhanced Liquidity

Traditional assets were illiquid, but blockchain can enhance the liquidity of assets like real estate. It turns real-world assets into digital tokens that can be traded easily. Moreover, fractional ownership opens doors for more investment opportunities.

- Cost Efficiency

Blockchain minimizes costs associated with asset management. It automates processes and eliminates intermediaries. However, it also minimizes the chance of errors from manual reconciliation and reduces administrative costs. Another advantage is the facilitation of 24/7 instant settlement for speed and cost-effectiveness of transactions, which ultimately benefits financial institutions and investors alike.

- Greater Accessibility

High-value assets when fractionize, mean divided into small pieces of assets (tokens) can be owned by small investors too. Thereby, democratizing investment opportunities that were traditionally only available for wealthy individuals or institutions.

- Risk Reduction

Blockchain-based RWAs allow institutions to have diversification in their portfolios by adding tokenized versions of assets from various industries and geographies. As a result, it reduces exposure to specific asset classes or markets. It also improves risk management.

- Global Market Access

Traditional RWAs have a requirement of physical presence for investments which created geographical barriers. Blockchain provides cross-border transactions and access to global markets. Now, institutions can invest in tokenized assets from different regions. As a result, there is a more integrated and efficient global market.

- Transparency and Security

Blockchain records are immutable and transparent. They ensure all transactions are securely recorded and make it impossible to alter or manipulate. This type of transparency builds trust among investors and stakeholders. They get a verifiable trail of ownership and transaction history. As a result, there is no fraud and a high level of security for RWAs.

- Operational Efficiency

Traditionally RWA selling, owning and trading required long paper processes. However, smart contracts allow for the automatic execution of predefined actions, such as transferring ownership when certain conditions are met. This reduces the need for manual intervention. Thus, faster and more efficient operations.

- Access to New Asset Classes

Blockchain RWAs help institutions develop a variety of investment vehicles that appeal to different types of investors. These include tokenized bonds to real estate funds. It expands investment options and attracts a diverse investor base.

How Blockchain Empowers RWA Management?

Blockchain technology plays a great role in real-world assets (RWAs) management. It creates a ripple effect of innovations to streamline processes, enhance security, and drive institutional adoption. Let’s see the factors that are helping blockchain push the boundaries of traditional asset management:

- Smart Contracts

Smart contracts work as the backbone of blockchain to automate complex processes. These contracts are self-executed and written into blockchain code. They automate tasks like compliance verification, payment execution, and ownership transfers. The major benefit is that they can eliminate paperwork, and manual contracts which ultimately make you get rid of brokers means intermediaries. As a result, asset management becomes faster and cheaper. For example, in real estate, the transfer of ownership can be automatically triggered once the payment is made, with no mediator needed, no paperwork and transaction time from weeks to minutes.

- Oracles and Data Integrity

Many challenges with traditional asset management show that there is a need for blockchain integration. One of the challenges with blockchain asset tokenization is data integrity. But Chainlink introduced “decentralized oracles”. It is the solution to offer a secure and reliable method for feeding off-chain data into the blockchain. They can get data from different sources like market prices or real-world events. It also verifies that it is tamper-proof before sending it onto the blockchain.

- Interoperability

Traditional systems were soiled but blockchain can integrate with existing traditional financial systems. This is the key to its adoption by institutional investors. Blockchain allows for interoperability to communicate and interact seamlessly with legacy financial infrastructures, like banking systems, payment processors, and market exchanges. This ability to work alongside traditional financial systems makes blockchain a viable solution for asset management on a global scale.

- Scalability and Speed

Blockchain scale operations without sacrificing speed. The major challenge with traditional financial systems was their reliance on centralized servers and processing power. This drawback creates bottlenecks when dealing with large volumes of transactions or complex asset management systems. However, blockchain uses a distributed ledger system that is inherently more scalable and capable of processing vast amounts of data in real time.

- Reduced Risk and Fraud Prevention

Blockchain’s immutable ledger provides a high level of security, reducing the risk of fraud and errors in RWA management. Every transaction is recorded on the blockchain and time-stamped, ensuring that the asset’s history is tamper-proof and verifiable by all parties involved. This level of transparency reduces the likelihood of fraud or mismanagement, offering a higher level of security for investors and asset managers.

- Global Accessibility and Inclusivity

Blockchain’s decentralized nature also helps increase access to high-value assets on a global scale. Traditional asset markets were limited by geographical and regulatory barriers. However, blockchain technology breaks down these walls and allows anyone with an internet connection to participate in the tokenized asset market.

Blockchain’s Transformative Impact on Real-World Assets: Stats

According to the Family Wealth Report, blockchain has revolutionized the tokenization of real-world assets (RWAs) by projecting a market reach, $16.1 trillion by 2030.

It represents 10% of global GDP. This growth highlights blockchain’s transformative power in financial markets and beyond. However there are other stats, let’s have a look at them:

- Real Estate:

In real estate, blockchain-based assets allow small investors to buy fractions of high-value properties such as a person who can own a $10 million property in New York or London while he is in Ohio. However, divided assets make individuals invest as little as $100. According to an article, the real estate tokenization market is expected to reach $1.4 trillion by 2026.

- Commodities:

Commodities refer to bonds, gold and stocks. Blockchain makes it possible for investors to own fractional shares. For instance, a $2,000 ounce of gold can be divided into 2,000 $1 shares. It lowers the capital needed for investment. According to marketsandmarkets, the tokenized commodities market is forecasted to grow to $4.5 billion by 2025.

- Intellectual Property:

Intellectual property refers to patents. Blockchain makes it easy to invest in patents for example: $1 million patent could be divided into 1 million tokens. It can open investment opportunities to a broader audience.

The Blockchain Platforms Promoting the RWA Revolution

The blockchain-based real-world assets (RWAs) involve various stakeholders. Each transforms traditional asset management. Let’s see a few blockchain platforms and their role in revolutionizing RWAs:

- Ethereum:

Ethereum is a pioneer in smart contract technology. It provides a robust platform for developing decentralized applications (dApps) and tokenizing assets. Moreover, it has a huge adoption and a developer community that acts as a foundational layer for RWA tokenization.

- Solana:

Solana is a blockchain known for its high-speed and low-cost transactions. This blockchain offers an efficient infrastructure for asset trading. Moreover, the scalability feature is an attractive option for projects aiming to handle large volumes of transactions.

- Polygon:

Polygon formerly known as Matic, operates as a Layer 2 scaling solution for Ethereum and has capabilities to reduce transaction costs. In this way, it can facilitate the creation of tokenized ecosystems. Moreover, its interoperability with Ethereum ensures a seamless user experience

Final Words

Blockchain sets a new foundation for real-world asset management. It has come a long way since its inception with cryptocurrency. Now, it shows potential beyond like decentralized, digital currency system that is a game-changing technology. Blockchain has the real potential to revolutionize how we manage and trade real-world assets (RWAs). It can tokenize assets, commodities and more. It is reshaping many industries with its ability to provide access and transparency. Furthermore, blockchain-driven RWAs are creating new pathways for investment with fractional ownership, faster payments, faster transfer and accessible markets. As this technology continues to mature, businesses across sectors should explore the immense potential of blockchain in asset management and tokenization. The time to act is now.

Join The Blockchain Revolution!

OptimusFox is a blockchain development company. We have a team of blockchain developers, architects and experts who are specialized in navigating your challenges and proposing solutions that work for your business. Our suite of blockchain development services ranges from smart contracts to NFT development. We also provide custom solutions for businesses to get the maximum benefit of blockchain integration.

Unlock the future of asset management today.